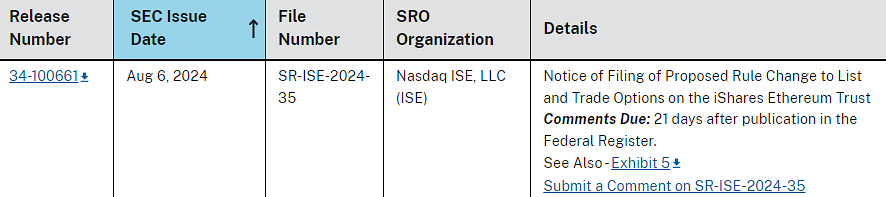

Nasdaq and BlackRock, the world's largest asset manager, have submitted a proposal to the U.S. Securities and Exchange Commission (SEC) to start trading options on the spot Ethereum ETF, specifically the iShares Ethereum Trust ETF (ETHA), which is the only Ethereum-based ETF listed on the Nasdaq exchange. The proposal includes modifying the rules for listing and trading options on the ETF, with the intention of broadening the list of ETFs eligible for options trading.

The SEC will accept comments on this proposal for 21 business days, though a final decision on the matter isn't expected until April 2025. To move forward with trading options on the spot Ethereum ETF, BlackRock needs approvals not only from the SEC but also from the Commodity Futures Trading Commission (CFTC) and the Options Clearing Corporation.

Currently, Nasdaq is also waiting for approval to trade options on spot Bitcoin ETFs, a decision the SEC has postponed, needing more time to evaluate this category of products.

Options are financial contracts that allow investors to buy or sell an underlying asset, such as Ethereum, at a predetermined price and time. These contracts are popular among retail investors for speculation and hedging, offering potentially high returns with limited losses, as the maximum loss is capped at the cost of the option premium.

BlackRock's introduction of options on the spot Ethereum ETF would provide an additional, cost-effective tool for investors to engage with digital assets, either for speculation or as a hedge against their investment portfolios.

Since January's approval of a spot Bitcoin ETF, many financial institutions, including BlackRock and Fidelity, have been actively pursuing the creation of cryptocurrency exchange-traded funds (ETFs). The goal is to allow investors to gain exposure to cryptocurrencies like Ethereum without directly holding the assets.

The SEC approved the launch of a spot Ethereum ETF in the U.S. on May 23, and several major financial players, including BlackRock, 21Shares, Bitwise, Fidelity Investments, Franklin Templeton, VanEck, and Invesco Galaxy, have received the green light from the regulator.

The ETH-ETF products began trading on July 23, and within the first 15 minutes, the sector experienced $112 million in trading volume.

In addition to this move, BlackRock has previously launched ETFs utilizing options strategies on U.S. stocks, such as the iShares S&P 500 BuyWrite ETF (IVVW) and the iShares Russell 2000 BuyWrite ETF (IWMW), which focus on large-cap and small-cap stocks, respectively. These funds use a covered call strategy to generate monthly income for investors through option premiums and potential stock price appreciation, subject to a specified limit.

Given BlackRock's impressive track record and its significant assets under management, it is highly likely that their efforts to launch new crypto-based investment products will succeed, attracting further interest and capital to the cryptocurrency market.