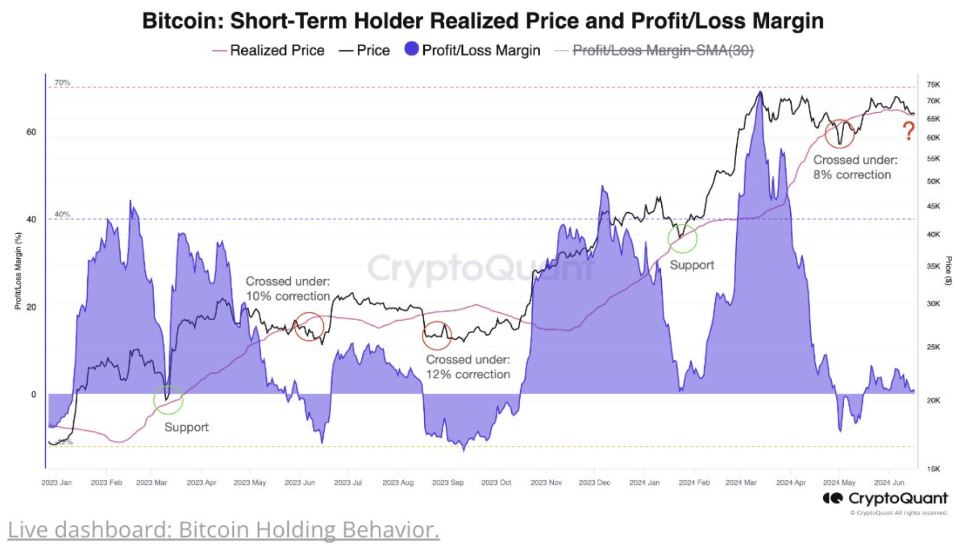

Bitcoin's recent dip below $64,000 has raised concerns among traders and analysts, signaling a potential further decline. Cryptocurrency analysis firm CryptoQuant noted this break in a June 21 X post, emphasizing that Bitcoin had fallen below the critical support level of $65.8K and was now trading under $64K. This breach suggests a possible 8%-12% correction towards $60K, a level not seen since May 3, when Bitcoin was at $59,122 according to CoinMarketCap.

On June 22, Bitcoin's price continued to drop, falling 2% to $63,442. This decline brought it below the short-term holder realized price (STH-RP) of $64,230, as per LookIntoBitcoin data. The STH-RP is a significant indicator for traders, representing the aggregate cost basis of wallets holding Bitcoin for 155 days or less. Historically, this metric has acted as solid support during bull markets since early 2023. However, the recent breach has raised concerns about a further decline.

"Bitcoin's short-term holder realized price generally acts as support in upward trending markets," noted pseudonymous trader Crypto Caesar on June 19. LookIntoBitcoin founder Phillip Swift added, "Let's see if it holds."

A drop to $60,000 could liquidate $1.64 billion in long positions, according to CoinGlass data. Bitcoin has been hovering around $65,000, prompting speculation about its next move, especially following significant events like the launch of spot Bitcoin ETFs in the U.S. in January and the Bitcoin halving in April.

Ki Young Ju, founder and CEO of CryptoQuant, remains optimistic about Bitcoin's long-term potential. He believes that the network's fundamentals could support a market cap three times its current size compared to the last cyclical peak. On May 8, Young Ju highlighted a chart comparing Bitcoin’s price, hash rate, and market capitalization ratio, underscoring Bitcoin’s resilience despite its volatility. If this ratio continues to grow, he suggests Bitcoin’s price could potentially reach $265,000.